ASBIS in H1 2012: Successful Q2 2012 Supported H1 2012 Results. Increased Revenues and Decreased Expenses Resulted in Strong Growth in Profits

Revenues increased by 20.76% in Q2 and 14.17% in H1 2012, to USD 744.9 million for the first six months of the year. As a result, net profit grew to USD 2.55 million

Revenues increased by 20.76% in Q2 and 14.17% in H1 2012, to USD 744.9 million for the first six months of the year. As a result, net profit grew to USD 2.55 million

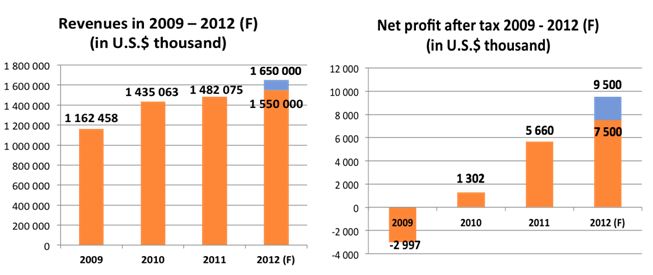

Limassol, Cyprus, August 9 th , 2012 -- ASBISc Enterprises Plc, a leading distributor of IT products in emerging markets of Europe, the Middle East and Africa, closed a successful Q2 2012. The Company posted revenues of USD 365.76 million for the second quarter of 2012, 20.76% higher than in Q2 2011. H1 2012 revenues grew by 14.17% to USD 744.94 million. At the same time the Company increased gross profit after currency movements by 6.21% and significantly reduced selling, admin and finance expenses. As a result, EBITDA for H1 2012 was USD 8.04 million, compared to USD 3.87 million in H1 2011; net profit was USD 2.58 million, compared to a net loss of USD 3.13 million in the corresponding period of 2011. Thus ASBIS is on track to deliver the forecasted results for Y2012: USD 1.55 billion to USD 1.65 billion of revenues and USD 7.5 million to USD 9.5 million of net profit after tax.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “Although the second quarter is traditionally the weakest period during the year, we managed to significantly increase our revenues and gross profit and support our H1 results. It is worth underlining that we managed this growth under tough market conditions, at a time of uncertainty about the situation on global markets. Achievement of positive results was possible mostly due to the good geographical diversification of our operations and because of a much-improved product portfolio in many countries. We believe that margins will grow again in the second half of the year, which is traditionally much better in the distribution business.”

The CEO and Chairman continued: “In H1 2012, besides growth in the top line, we successfully managed to decrease our expenses at all levels. Selling expenses decreased by 5.49% and admin expenses by 9.63%. This was a result of rebuilding our cost structure and linking expenses more to gross profit than to revenues. Financial expenses also decreased significantly, by 17.27%. With increased revenues and gross profit, and with very good hedging that shielded our results from any material currency losses, we were able to increase profits at all levels, with the most significant change at the level of net profit, which grew to almost USD 2.6 million, compared to a loss of about USD 3 million last year. All of these issues, and the structural changes we have implemented, allow us to expect that in the second half of the year we will continue a healthy and profitable business.”

FINANCIAL RESULTS IN Q2 2012 AND Q2 2011 (in USD thousand)

| Q2 2012 | Q2 2011 | Change |

Revenues | 365,755

| 302,880

| +20.76%

|

Gross profit after currency movements | 16,240

| 14,643

| +10.91%

|

Gross profit margin | 4.44% | 4.83% | -8.08% |

Administrative expenses | (5,531)

| (6,382)

| -13.34%

|

Selling expenses | (8,590)

| (9,675)

| -11.21%

|

Operating profit | 2,119

| (1,414)

| N/A |

EBITDA | 2,751 | (632) | N/A |

Net profit | 319

| (3,955)

| N/A |

FINANCIAL RESULTS IN H1 2012 AND H1 2011 (in USD thousand)

| H1 2012 | H1 2011 | Change |

Revenues | 744,938

| 652,499

| +14.17%

|

Gross profit after currency movements | 36,212

| 34,095

| +6.21%

|

Gross profit margin | 4.86% | 5.23% | -7.08% |

Administrative expenses | (11,495)

| (12,721)

| -9.63%

|

Selling expenses | (17,993)

| (19,037)

| -5.49%

|

Operating profit | 6,725

| 2,337

| +187.76%

|

EBITDA | 8,036 | 3,874 | +107.43% |

Net profit | 2,576

| (3,127)

| N/A |

FINANCIAL FORECAST FOR 2012

For 2012 ASBIS has forecasted revenues between USD 1.55 billion and USD 1.65 billion and NPAT from USD 7.5 million to USD 9.5 million.

DETAILED INFORMATION ON SALES PROFILE

Traditionally and throughout the Company's operation, the region contributing the majority of revenues has been the Former Soviet Union. This was also the case in Q2 and H1 2012, when revenues derived from FSU countries grew by 25.75% and 15.32% respectively, compared to the corresponding periods of 2011. More importantly, this growth was also observed in all other regions of our operations. Revenues in CEE grew by 15.66% and 12.01% in Q2 2012 and H1 2012 respectively, and revenues in the Middle East and Africa grew by 31.89% and 23.23%. In addition the Company was able to increase revenues derived in Western Europe by 8.27% in Q2 2012 and 5.49% in H1 2012.

“Our strategy is to focus on our main markets, and this is paying off,” commented Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc. “During H1 our results were driven by our biggest single market – Russia – where we delivered 21.98% and 15.97% growth for Q2 2012 and H1 2012 respectively. Additionally, other major markets grew, like Ukraine (by16.95% and 9.66% for the same periods), and we had growth in many other countries, such as the United Arab Emirates (112.22% and 89.80% respectively), the Czech Republic (11.61% and 7.31%), Kazakhstan (15.93% and 29.74%) and Bulgaria (43.96% and 40.22%). It is notable that after some turbulence in 2011, sales in Belarus grew again and therefore this country re-entered the list of our top 10 countries. The abovementioned strategy allowed us to increase total revenues by 20.76% in Q2 2012 and 14.17% in H1 2012.”

REVENUE BREAKDOWN BY REGIONS IN H1 2012 AND H1 2011 (in USD thousand):

Region | H1 2012 | H1 2011 | Change % |

Former Soviet Union | 300,026 | 260,159 | +15.32% |

Central and Eastern Europe and Baltic States | 249,773 | 222,991 | +12.01% |

Middle East and Africa | 115,370 | 93,625 | +23.23% |

Western Europe | 55,968 | 53,163 | +5.28% |

Other | 23,802 | 22,563 | +5.49% |

Total | 744,938 | 652,499 | +14.17% |

REVENUE BREAKDOWN IN H1 2012 AND H1 2011 - TOP 10 COUNTRIES (in USD thousand)

| H1 2012 | H1 2011 | ||

| Country | Sales | Country | Sales |

1. | Russia | 175,859 | Russia | 151,640 |

2. | Slovakia | 72,159 | Slovakia | 70,483 |

3. | Ukraine | 69,009 | Ukraine | 62,929 |

4. | United Arab Emirates | 65,537 | Czech Republic | 36,908 |

5. | Czech Republic | 39,606 | United Arab Emirates | 34,531 |

6. | Kazakhstan | 31,093 | Saudi Arabia | 25,620 |

7. | Bulgaria | 20,791 | Kazakhstan | 23,966 |

8. | The Netherlands | 19,689 | Belarus | 17,583 |

9. | Lithuania | 18,366 | Romania | 16,602 |

10. | Belarus | 17,955 | Bulgaria | 14,828 |

11. | Other | 214,874 | Other | 197,410 |

| TOTAL | 744,938 | TOTAL | 652,499 |

For additional information, please contact:

Daniel Kordel , ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

Tel. +48 509 020 021

E-mail: d.kordel@asbis.com

Costas Tziamalis , ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

Iwona Mojsiuszko , M+G

Tel. +48 22 625 71 40,

Tel. +48 501 183 386

E-mail: iwona.mojsiuszko@mplusg.com.pl

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide. The Group distributes products of many vendors and manufactures and sells private-label products: Prestigio (external storage, leather-coated USB accessories, GPS devices, etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, more than 1,000 employees and 32,000 customers. The Company's stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, visit also the company's website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.